February 2024 Performance Review: A Cautiously Optimistic Outlook

15 March 2024

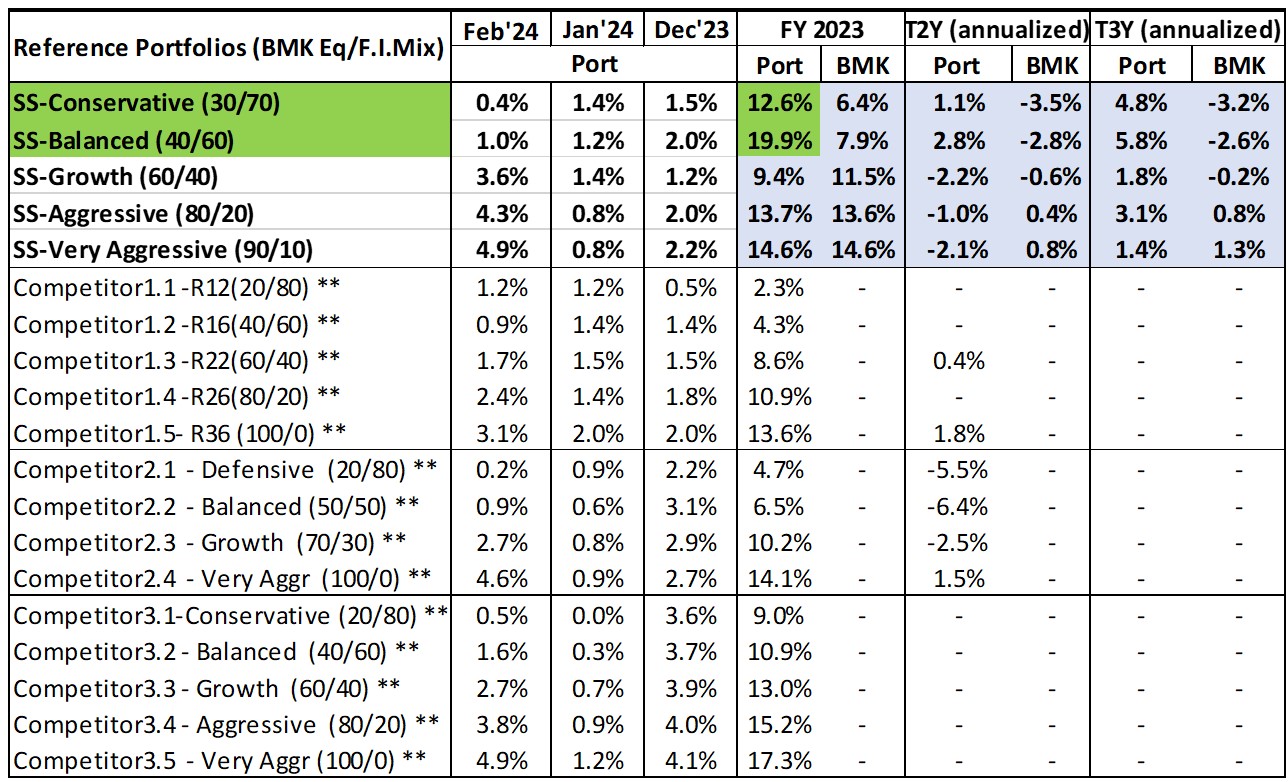

In February, our portfolios showcased robust performance, standing out as leaders amongst our competitors – a testament to the resilience of our investment approach despite market uncertainties. Our success this month is particularly notable in our portfolios geared towards higher-risk assets, which have undergone a notable transformation, surpassing our competitors' performance. Meanwhile, our lower-risk portfolios have demonstrated their reliability, maintaining stability amidst fluctuating market dynamics.

1-Year Performance Overview

Over the past year, SqSave's portfolios, especially those categorized as low risk, have consistently surpassed both our benchmarks and our competitors’ performance. Notably, our low-risk portfolios have maintained a remarkable lead, showcasing resilience and stability in volatile market conditions. Similarly, our high-risk portfolios have shown strong performance, closely aligning with benchmarks. Additionally, we have outperformed some competitor portfolios. This underscores the effectiveness of our investment strategies across risk profiles.

3-Year Performance Overview

Furthermore, our three-year trailing performance reaffirms the strength and consistency of our investment approach. Across all portfolio categories, SqSave's performance has consistently outpaced benchmarks, reflecting our commitment to delivering superior returns over the long term. This sustained outperformance not only validates the efficacy of our strategies but also reinforces our position as a trusted partner for investors seeking reliable and robust investment solutions.

Future Outlook

Looking ahead, we recognize the significance of diligently monitoring our fund's performance, particularly following recent strategic adjustments. Maintaining a cautiously optimistic stance, we anticipate that our refined strategies will yield improved investment outcomes and better align with evolving market trends. As we progress into the future, we remain committed to enhancing our performance and adapting effectively to changing market landscapes. Challenges may arise, but we are confident in our ability to deliver value to our investors through prudent decision-making and a steadfast commitment to excellence.

Conclusion

In conclusion, February signifies another milestone in our journey towards securing investment success for our clients. With a steadfast commitment to excellence and a cautiously optimistic outlook, we are well-equipped to navigate the evolving investment landscape. We are grateful for the trust placed in us by our investors and remain dedicated to delivering superior results.

SqSave Reference Portfolios Returns Summary (SGD terms as at 29 Feb 2024)*

*Inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

** Performance numbers for competitors are estimates. Abbreviations: BMK: Benchmark; Ret: Return, T2Y: Annualized Time Weighted Return

Yours sincerely

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Strategic Investment Perspectives Amid Market Volatility: Outlook for the Next 3 to 6 Months

Team SqSave

The year 2024 stands as a pivotal period marked by transformative changes. The unfolding events are not only intriguing for us to observe but likely to be chronicled by historians.

Read more

January 2024 Performance Review and Strategic Adjustments

Team SqSave

In January, our portfolios displayed strong performance, with the majority surpassing their benchmarks.

Read more

Ending 2023 With A Bang: SqSave Portfolios Outperformed and Ready For 2024

Team SqSave

FY2023 has been an excellent year for our SqSave reference portfolios, with the majority of our portfolios beating or being on par with the benchmark. The following is a brief recap for 2023.

Read more