MoneyBox

low risk portfolio

seeks better returns than bank deposits

Latest 1 Year Return 4.28% p.a.2

(as at 30 Nov 2024)

invests in cash & fixed income,

using our investment expertise & quantitative tools

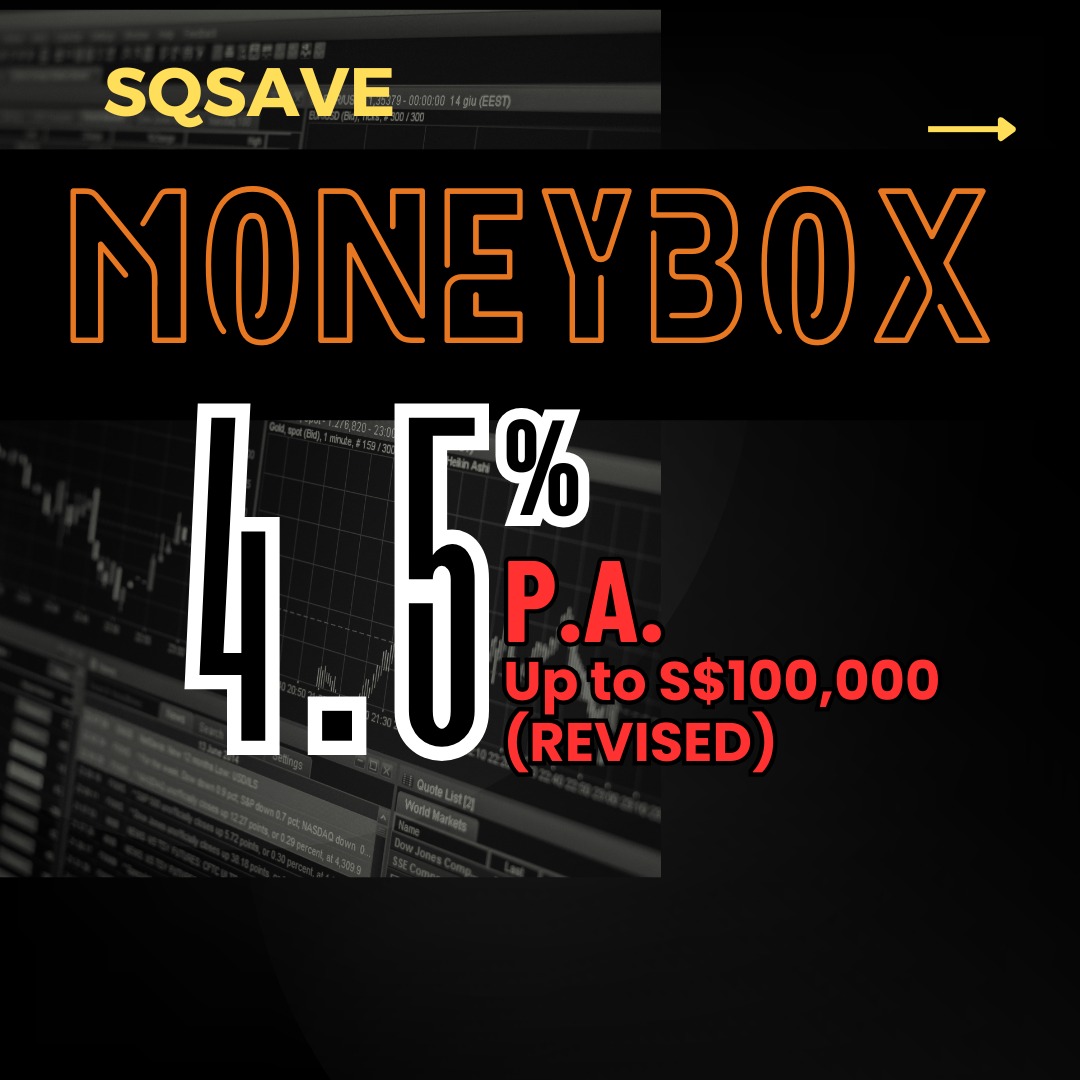

MoneyBox Promotion 2

Get 4.5% p.a.

on monies deposited!

Promo valid till 31 Mar 2025.

Important Note: MoneyBox returns may fluctuate up or down, based in part on the performance of the underlying funds. Past returns are not necessarily representative of future or likely performance. This performance, in turn, is dependent on Singapore’s economic health as well as the 12-month trajectory of global interest rates. When applicable, we may review and re-optimise the MoneyBox portfolio allocation (including the selection of underlying funds within) to attempt to maintain the highest possible return within a given economic environment.

1 Return is net of underlying management fee and other fees charged by the underlying Funds issuer.

Annual Return Formula: (((0.695 x (Latest Fund Price 1 / Year Ago Fund Price 1) – 1) + (0.295 x (Latest Fund Price 2 / Year Ago Fund Price 2) – 1)) x 100)

2 MoneyBox Fact Sheet

Disclosure Regarding Moneybox Promotion Top-up Entitlements:

Moneybox Promotion 1:

Top-up Entitlement Formula = Deposit * 1.05D/365 - NAV

Where;

Deposit = SGD MoneyBox deposit amount;

D = number of days from the Investment Start Date until 31 Dec 2024;

NAV = actual SGD net asset value of MoneyBox portfolio calculated using underlying asset prices for 31 Dec 2024.

Moneybox Promotion 2:

Top-up Entitlement Formula = Deposit * 1.045D/365 - NAV

Where;

Deposit = SGD MoneyBox deposit amount;

D = number of days from the Investment Start Date until 31 Mar 2025;

NAV = actual SGD net asset value of MoneyBox portfolio calculated using underlying asset prices for 31 Mar 2025.

Note: Investment Start Date refers to the date when processing of the MoneyBox deposit has fully completed (i.e. first day the Deposit is reflected in the MoneyBox Portfolio Value). Where multiple deposits are made into a MoneyBox Portfolio, we will calculate the top-up amount entitled for each Deposit separately.

MoneyBox FAQs

MoneyBox is our cash management solution offering enhanced returns versus bank savings and retail fixed deposit accounts. It offers higher yet safe returns by presently investing in a combination of specially selected unit trust funds. You can deposit any amount without restrictions or withdrawal penalties. It can also be held conveniently until you're ready to shift into other SqSave portfolios created for longer term needs.

It's currently comprised of an allocation of 70% UOB United SGD Fund Class B Acc and 30% UOB United SGD Money Market Fund Class B. The Funds and allocations are reviewed and assessed annually with changes made if warranted to maintain or enhance risk adjusted returns.

No, you are free to invest in MoneyBox as long as you wish, without any obligation to invest in another portfolio for your SqSave account.

It currently takes about 2-3 business days for deposits to appear in your SqSave account (barring unforeseen factors), depending on the timing of your deposit. Faster processing is offered for SqCash transfers before 11:30am on any business day and before 10pm prior to next business days. Withdrawals currently typically take 3-5 business days to reach your bank account, barring unexpected occurrences.

See more MoneyBox FAQs here

MoneyBox Promotion 2 FAQs

The MoneyBox Promotion 2 is an opportunity for investors (new and existing SqSave clients) to earn a 4.5% annualized return from now until 31 Mar 2025 (“Qualifying Return Period”). This applies to all MoneyBox portfolio deposits made during the period of 1 Dec 2024 to 31 Mar 2025 ("Promotion Period").

All existing and new SqSave clients with a valid SqSave account are eligible to participate in this Promotion.

The minimum MoneyBox deposit of SGD 1 and a maximum net MoneyBox deposit limit of SGD 100,000 per client applies (“Qualifying Amount”) during the Promotion Period. Additional net deposits exceeding SGD 100,000 during the Promotion Period will earn prevailing MoneyBox net asset value returns.

Annualised returns of 4.5% will be calculated on all clients’ MoneyBox deposits received (including multiple top-ups) during the Promotion Period.

See more MoneyBox Promo 2 FAQs here